Using Payments API

Implementing the Payment Intent Flow with Accrue Pay

Introduction

This guide provides a comprehensive overview of the Payment Intent flow within Accrue Pay's Merchant API. Payment Intents represent a customer’s intent to make a payment and are used to track and manage a payment’s lifecycle from creation to settlement.

What is a Payment Intent?

A Payment Intent is a key object that:

- Captures the customer’s selected payment method (Accrue Wallet or Bank Account)

- Represents their choices at checkout

- Manages payment authorization, capture, and settlement

- Tracks the state of a payment across its entire lifecycle

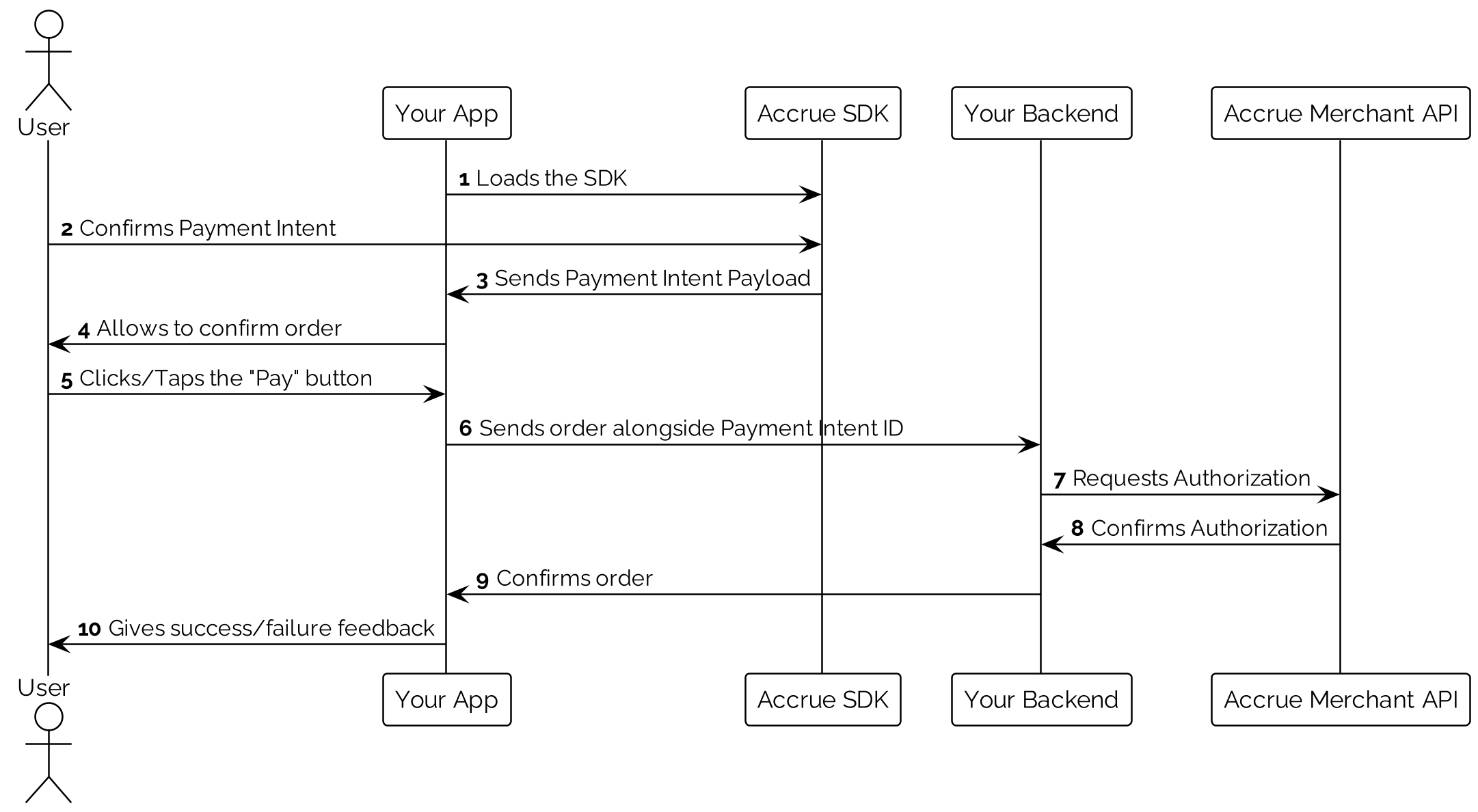

End-to-End Integration Flow

The following diagram outlines the full integration journey across Customer, Merchant Frontend, Merchant Backend, and Accrue Pay:

Flow Overview

-

Customer Interaction (Merchant Frontend)

- Customer selects Accrue Pay at checkout

- Completes checkout flow with either Wallet or Bank Account

- Completes any necessary authentication

- A Payment Intent is created via the frontend SDK

-

Frontend to Backend Handoff

- The frontend sends the Payment Intent ID to your backend

- The backend prepares to authorize the intent

-

Backend Processing

- Authorizes the Payment Intent, converting it into a Payment

- Captures the authorized payment

- Confirms success and updates the order status

-

Finalization

- Merchant fulfills the order

- Accrue Pay settles funds based on the agreed schedule

Detailed Payment Intent Flow

1. Creating a Payment Intent

A Payment Intent is initiated when the customer selects Accrue Pay and a payment method. The frontend SDK handles:

- Presenting payment method options

- Authenticating the user

- Initiating the Payment Intent object with the selected method

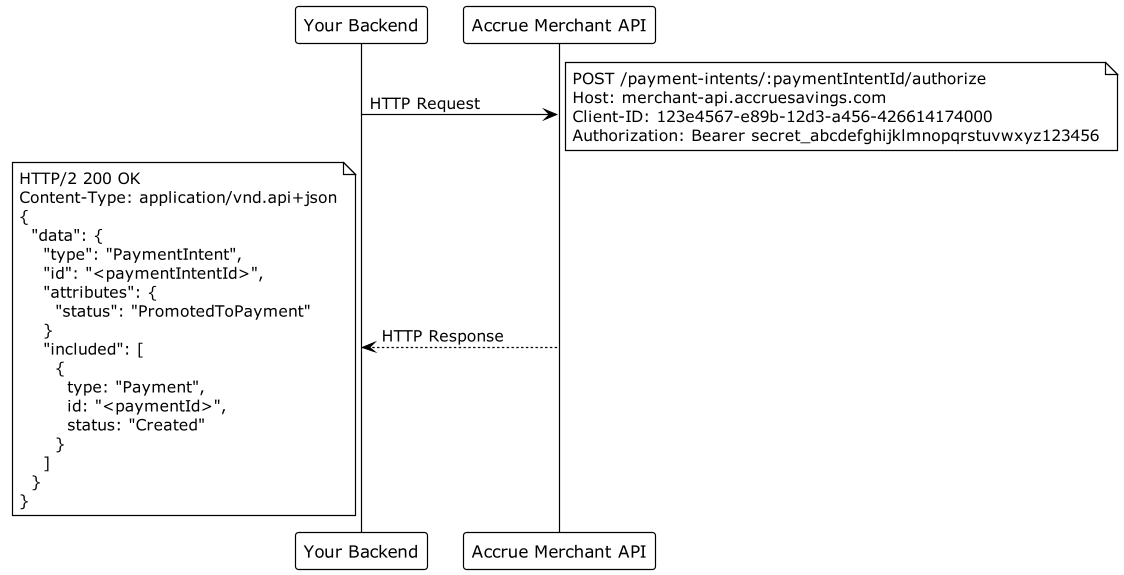

2. Authorizing a Payment Intent

Once the Payment Intent is created, your backend must authorize it. Authorization reserves the funds and converts the intent into a Payment.

API Endpoint: POST /payment-intents/:paymentIntentId/authorize

Request:

{

"data": {

"type": "payment_authorizations",

"attributes": {

"amount": 10000,

"currency": "USD",

"capture_method": "automatic",

"description": "Order #12345"

}

}

}

Response:

{

"data": {

"id": "pay_abc123xyz789",

"type": "payments",

"attributes": {

"amount": 10000,

"currency": "USD",

"status": "authorized",

"description": "Order #12345",

"created_at": "2025-05-12T14:22:33Z"

},

"relationships": {

"payment_intent": {

"data": {

"id": "pi_def456uvw123",

"type": "payment_intents"

}

}

}

}

}

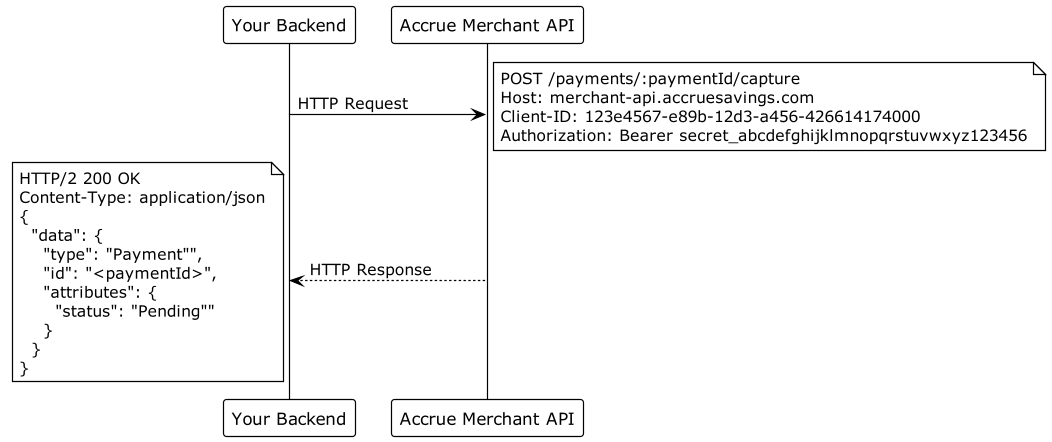

3a. Capturing a Payment (Bank Rails)

Authorized payments must be captured to initiate fund transfers. Capture can be automatic or manual, depending on your configuration.

API Endpoint: POST /payments/:paymentId/capture

Request:

{

"data": {

"type": "payment_captures",

"attributes": {

"amount": 10000

}

}

}

Response:

{

"data": {

"id": "pay_abc123xyz789",

"type": "payments",

"attributes": {

"amount": 10000,

"currency": "USD",

"status": "captured",

"description": "Order #12345",

"created_at": "2025-05-12T14:22:33Z",

"captured_at": "2025-05-12T14:25:10Z"

}

}

}

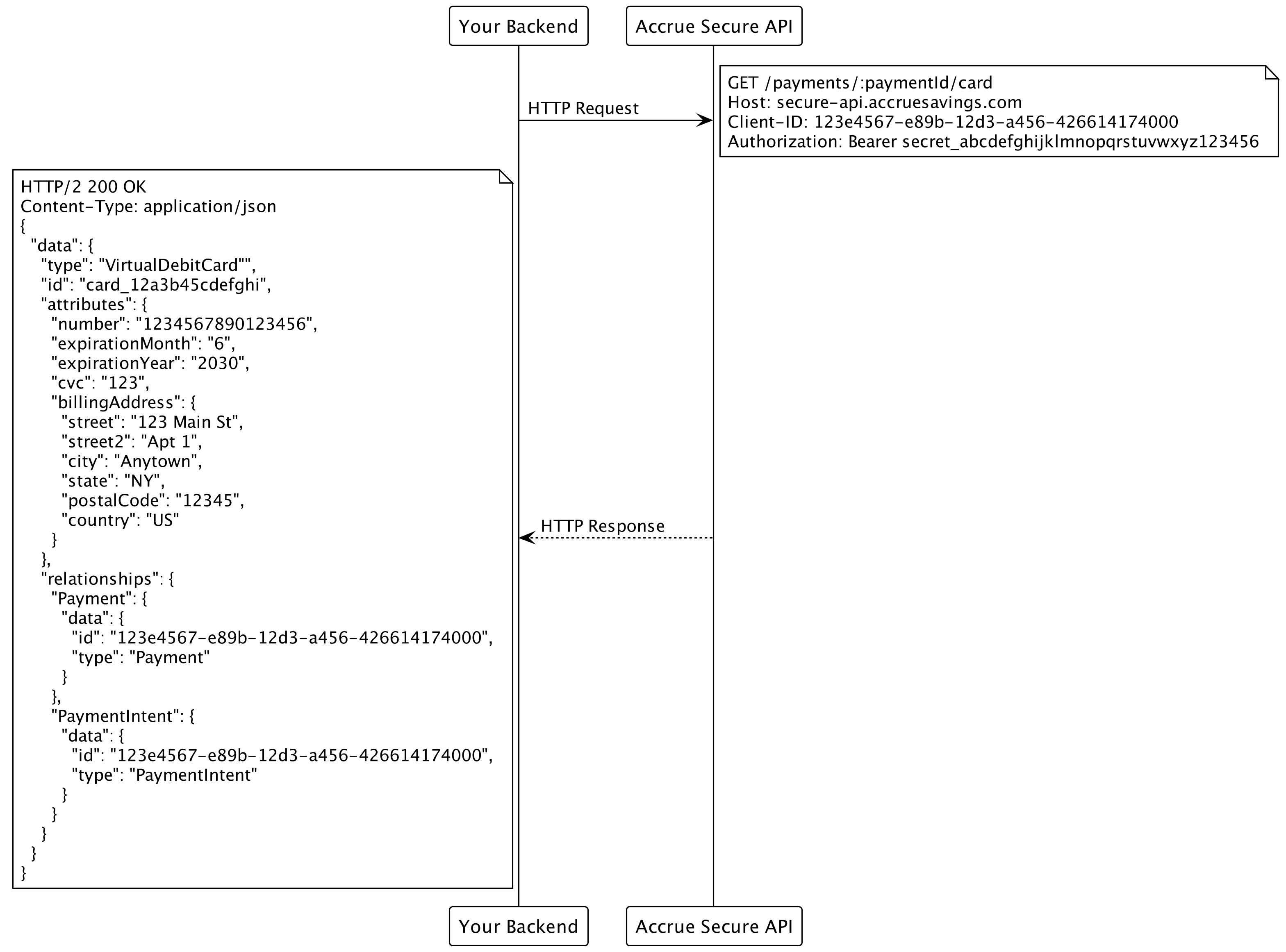

3b. Capturing a Payment (Card Rails - Using Virtual Debit card)

When using the card rails integration option, Accrue Pay provides a virtual debit card that you can process through your existing payment gateway.

After authorizing the Payment Intent, follow these steps to capture the payment using the virtual debit card:

Step 1: Retrieve the virtual debit card details using the secure API

API Endpoint: GET https://secure-api.accruesavings.com/api/v1/payments/:paymentId/card

Headers:

x-client-id: your_client_id

x-client-secret: your_client_secret

Response:

{

"data": {

"id": "497f6eca-6276-4993-bfeb-53cbbbba6f08",

"type": "VirtualDebitCard",

"attributes": {

"number": "5555555555554444",

"expirationMonth": "6",

"expirationYear": "2028",

"cvc": "123",

"billingAddress": {

"street": "123 Main St.",

"street2": "Apt. 1",

"city": "San Francisco",

"state": "CA",

"postalCode": "94107",

"country": "US"

}

},

}

}

Step 2: Process the virtual debit card through your payment gateway

Use your existing payment gateway to process the virtual debit card details:

- Submit the card details (number, expirationMonth, expirationYear, cvc) to your payment gateway

- Use the same amount that was authorized in the Payment Intent

- Store both the Accrue Pay payment ID and your gateway's transaction ID for reconciliation

Example integration with a payment gateway:

// Example code - implement according to your payment gateway's API

const processMastercard = async (cardDetails, amount) => {

const response = await paymentGateway.processCard({

card_number: cardDetails.attributes.number,

expiry_month: cardDetails.attributes.expirationMonth,

expiry_year: cardDetails.attributes.expirationYear,

cvv: cardDetails.attributes.cvc,

billing_address: {

street: cardDetails.attributes.billingAddress.street,

street2: cardDetails.attributes.billingAddress.street2,

city: cardDetails.attributes.billingAddress.city,

state: cardDetails.attributes.billingAddress.state,

postal_code: cardDetails.attributes.billingAddress.postalCode,

country: cardDetails.attributes.billingAddress.country

},

amount: amount,

currency: 'USD',

description: 'Order #12345 (Accrue Pay Virtual Card)'

});

return response.transaction_id;

};

Important Notes on Card Rail Integration:

- Never store the full card details on your servers; use them only for the immediate payment processing

- Ensure your system is PCI compliant if handling card data

- The virtual debit card is a single-use card tied to the specific authorized amount

- For future payments from the same customer, you'll need to generate a new virtual card

- If needed, you can cancel the authorization by calling the

/payments/:paymentId/cancelendpoint

Payment Lifecycle

The Payment Intent and its associated Payment transition through the following statuses:

| Status | Description |

|---|---|

created | Payment Intent was successfully created |

authorized | Payment has been authorized but not yet captured |

requires_capture | Authorized with manual capture; awaiting capture |

captured | Payment successfully captured |

processing | Payment is being processed through the financial network |

succeeded | Payment completed successfully |

settled | Funds have been deposited into the merchant account |

canceled | Payment was canceled prior to capture |

failed | Payment failed due to authorization or processing errors |

Error Handling

Accrue Pay returns standard HTTP status codes along with descriptive error messages.

| Status Code | Meaning |

|---|---|

400 | Invalid request |

401 | Authentication failed |

403 | Permission denied |

404 | Resource not found |

422 | Validation error |

500 | Internal server error |

Example Error Response:

{

"errors": [

{

"status": "422",

"code": "insufficient_funds",

"title": "Insufficient Funds",

"detail": "The customer's account has insufficient funds to complete this payment"

}

]

}

Best Practices

1. Lifecycle Management

- Persist

Payment Intent IDwith your order data - Implement retry logic for recoverable errors

- Use webhooks to track payment status updates asynchronously

2. Security Guidelines

- All sensitive operations (authorize, capture) must be backend-only

- Never expose API credentials in frontend code

- Implement idempotency keys to prevent duplicate operations

3. Testing and Go-Live Readiness

- Use the Sandbox environment for full integration testing

- Simulate both successful and failed scenarios

- Validate end-to-end flow including fund settlement before production launch

The Payment Intent architecture enables a flexible and secure integration path for handling payments with Accrue Pay. Following this implementation guide will help ensure a reliable and compliant checkout experience.

Ready to implement Accrue Pay in your application?

Contact us at info@byaccrue.com to get started